The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The cookie is used to store the user consent for the cookies in the category "Performance". This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. The cookies is used to store the user consent for the cookies in the category "Necessary". The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". The cookie is used to store the user consent for the cookies in the category "Analytics". These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly. Loans at beginning of period – Loans at end of period = Difference = Inflow/(Outflow) If the loans or borrowings decrease, this is due to a repayment, which is an outflow of cash.

If loans and borrowings increase during the period, this means there has been an inflow of cash into the entity. The repayment of the principal is included as a cash flow from financing activities, because it is the same as the repayment of a debt. The interest element is treated as a standard interest payment and is included as either a cash flow from operating activities or financing activities. The payment to the leasing company is split between an interest portion and a principal portion. However, the payment of interest and principal element of finance leases will need to be reflected in the statement of cash flows. We saw how assets acquired under finance leases are not included in the purchase of assets for cash purposes. To calculate the cash raised from the issue of shares during the period, compare the ordinary share capital and share premium account at the start of the period to the end of the period.

#Financing activities in cash flow statement how to

However, if you need to calculate the amount of dividends paid during the year, but only have retained earnings and profit after tax figures, here’s how to do it.:ĭeduct: Retained earnings at end of period If the dividend for this year is only proposed, but not paid, it should be excluded from the statement of cash flows.ĭividend payments in the year will normally be contained in the Statement of Changes in Equity. This might include the final dividend from the previous financial period, and an interim dividend issued during the period, if any.

Make sure you only include dividends actually paid during the year in the statement of cash flows. Some entities prefer to disclose dividends as part of operating activities, to show users of the financial statements that it can make these dividend payments from operating cash flows.

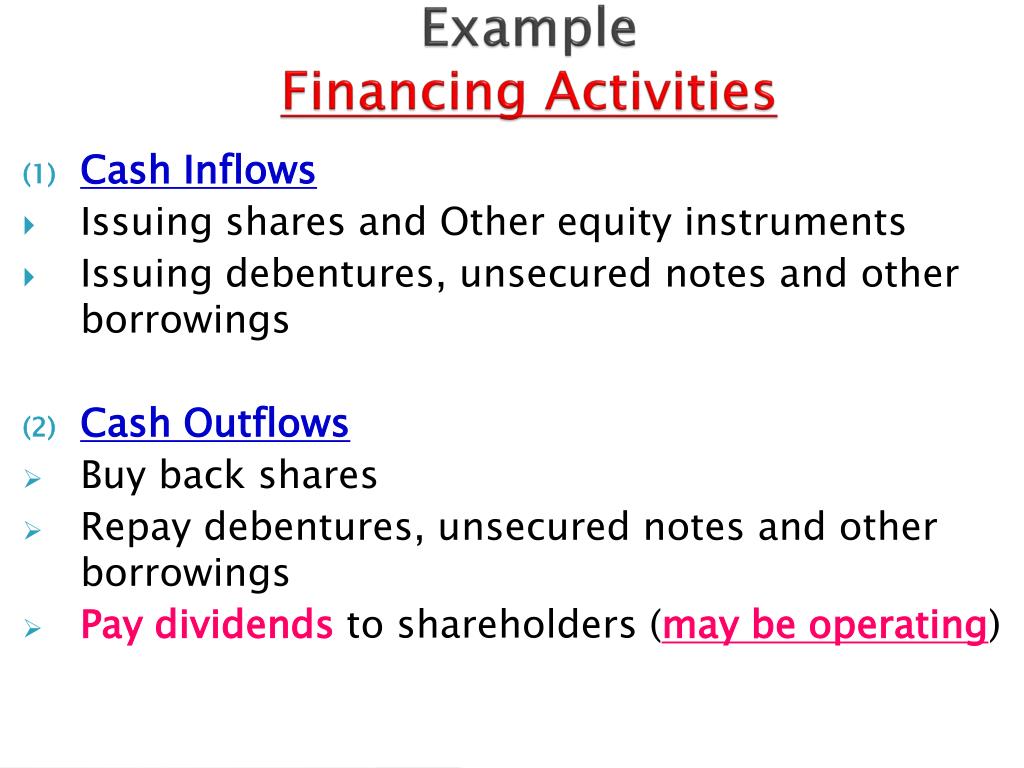

Shareholders who buy shares in the entity may expect dividends in the same way a bank will expect interest on a loan. Dividends paidĭividends paid are normally treated as financing activity, because they are a cost of obtaining financial resources, in the form of equity investment. This is true if the loan is not used as an integral part of the cash management function of the business. If you look at what the loans relating to the interest are for, it could be more appropriate to classify it as a financing activity. Interest paid is normally considered a cash flow from operating activities. Cash outflows from payments of interest which isn’t covered by operating activities.Cash outflows from buying back equity/shares.Cash inflows from raising loans, mortgages and other borrowings.Cash inflows from sale of equity/shares.This, in turn, allows you to estimate the future requirements to service this debt, or provide returns to shareholders.Įxamples of cash flows from financing activities include: This shows how the entity has been funded, its financial structure, and allows you to see how much debt and equity the entity has.

The third section of a statement of cash flows is for financing activities.įinancing activities are those activities, which relate to changes in the size and composition of the contributed equity and borrowings of the entity.

0 kommentar(er)

0 kommentar(er)